Step 2: Initiate the Transaction

What is an IFSC Code?

The full form of IFSC is Indian Financial System Code. It is an 11-digit alphanumeric code unique to each bank branch in India, which is used for online money transfers through National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS) systems. IFSC helps identify the source and destination bank branches for transactions.

Related Read: What is the Difference Between IMPS and NEFT Fund Transfer?

Contoh Penulisan IFSC Code

Penjelasan: “SBIN” adalah kode bank untuk State Bank of India. “0000” adalah kode cabang (misalnya, kode 0300 dalam contoh di atas).

Penjelasan: “ICIC” adalah kode bank untuk ICICI Bank. “0000” adalah kode cabang (misalnya, kode 0011 dalam contoh di atas).

Setiap kode IFSC memiliki format yang konsisten dengan 4 huruf pertama mewakili kode bank, angka kelima selalu “0”, dan 6 karakter terakhir mewakili kode cabang. Kode cabang bisa berupa kombinasi angka dan/atau huruf, sesuai dengan kebutuhan masing-masing bank.

IFSC Code memastikan transparansi dan akurasi dalam transaksi keuangan elektronik di India. Kode ini memungkinkan identifikasi tepat dari bank dan cabang, memfasilitasi transfer dana yang aman dan efisien.

When searching for an IFSC, keep the following things in mind

Daftar Tabel IFSC Code

Tabel IFSC Code berisi daftar lengkap kode IFSC untuk berbagai bank dan cabang di India. Tabel ini mencakup informasi penting yang diperlukan saat melakukan transaksi keuangan.

Sebelum melakukan transaksi, pastikan kode IFSC kalian benar! Untuk memastikan bahwa Kode IFSC yang kalian gunakan benar, kalian dapat klik link berikut untuk memvalidasi kode IFSC kalian: Validasi Kode IFSC

Sekarang kalian telah memiliki pengetahuan yang lebih dalam mengenai IFSC Code, dan sekarang kalian mengetahui bahwa IFSC Code merupakan suatu aspek penting dalam transaksi perbankan India. Untuk kirim uang ke India, Anda bisa gunakan Easylink sebagai Platform Transfer uang ke luar negeri.

Latest posts by Amanda Kayla Alika

Maaf, sedang ada perbaikan nih

Saat ini kami sedang melakukan pemeliharaan di Pusat Bantuan Flip. Namun jangan khawatir, kamu tetap bisa chat dengan Tim Flip kok.

Muat UlangChat Dengan Tim FlipKembali ke Beranda

Ever wondered what IFSC printed on our passbook/chequebook stands for, and what is its significance in the Indian banking sector? Let’s find out everything about it.

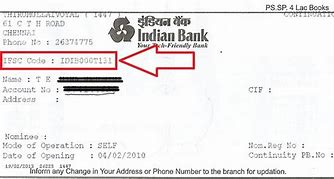

Most of us are familiar with the Indian Financial System Code or IFSC that is used for electronic money transfers. Yes, we are referring to the alpha-numeric code printed on bank documents like the front leaf of the passbook and the chequebook. But do you know what is an IFSC and why is it important for carrying out banking transactions? Here's all you need to know about it.

IFSC is an important part of the Indian banking infrastructure. It is a unique 11-digit number issued by the Reserve Bank of India (RBI), for identifying an individual bank and its specific branch. The format of IFSC is such, wherein the first four characters represent the bank's name, and the last six digits (combination of alphabets and numerals) indicate the location of the branch. The fifth character is zero and remains constant for all codes.

The first 4 alphabets (ICIC) in the above example serve to identify the bank, in this case - ICICI, and the last 6 digits (000053) represent its Jayanagar branch, in Bangalore.

It must be noted that no two banks or branches have the same code. In fact, the IFSC is different even for two accounts held in two different branches of the same bank. The RBI website has a list of all the banks and their IFSC.

What is the significance of IFSC?

The importance of the IFSC code cannot be stressed enough. It has made online transferring of funds easy, secure and accessible for all. Listed below, are some of the benefits it bestows:

IFSC ensures that fund transfers between banks are carried out seamlessly, without any blunders. The identification code can help RBI track, monitor, oversee, as well as authenticate all financial transactions conducted through modes such as the National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS).

IFSC plays a pivotal role in transferring money efficiently, from one bank account to another. It helps in determining the source as well as the recipient bank branch.

Since a valid IFSC is vital for initiating Fund Transfers through Net Banking, the online platform has become extremely safe. IFSC eliminates the odds of fraud, error, or theft during the Fund Transfer process.

Due to IFSC, the procedure of carrying out financial transactions, has not only become convenient but also picked up pace. Funds can be transferred in just a few minutes, from any corner of the globe. This is a boon for those in dire need of funds, due to a financial emergency.

Financial transactions through electronic modes are paperless. Thanks to IFSC, account-holders are doing their bit for Mother Earth, by using eco-friendly measures for money transfer.

As a rule, the IFSC cannot be changed, revised or updated. However, in the event of a merger or reorganisation of the bank, the IFSC identification code changes. In this case, the account holder is issued a new code. This is to ensure the online financial transaction is successful and it reaches the beneficiary's account, without any glitch.

As you can see, the IFSC code is an integral part of the modern banking system. Apart from making Internet Banking quick, safe, and convenient, it also indirectly contributes to a greener environment.

Terms and Conditions apply.

For disclaimer, Click Here.

Immediate Payment Service (IMPS)

Immediate Payment Service is a real-time electronic fund transfer method where the money is credited instantly to the payee or beneficiary account. It can be carried out at any time on a 24/7 basis. In this system, interbank transfers can be initiated via multiple channels such as SMS, ATM, mobile banking, NetBanking, etc. The primary advantage of IMPS over RTGS and NEFT is that the facility can be availed around the clock.

MICR is an acronym for Magnetic Ink Character Recognition. MICR code is a nine-digit code that speeds up the processing of cheques. MICR codes are unique for each bank branch and play a vital role in identifying both the bank and the branch participating in an Electronic Clearing System (ECS), which is a method of transferring funds electronically.

A MICR code has three essential components that provide information about the location, bank and branch of the cheque issuer. The structure of a MICR code is as follows –

Branch Locator tool

Most banks have a Branch Locator tool on their official website. You can use it to find the IFSC for a specific branch by entering the state, city and branch name. For example, if you enter “Uttar Pradesh” in the state field, “Lucknow” in the city field, and “Lucknow Main Branch” in the branch name field, your screen will display the IFSC of this branch.

It is crucial to enter the correct IFSC during an online transfer, as it ensures that the funds reach the intended recipient. If you enter an incorrect IFSC, your bank will decline the transaction.

Where to Find the IFSC & MICR Codes on a Cheque?

You can easily find both the IFSC and MICR codes on the bank’s chequebook and passbook. The IFSC is printed on the top of the cheque leaf, while the MICR code is printed on the bottom of the same leaf. You can also find both these codes on the first page of the passbook provided by the bank branch.

National Electronic Fund Transfer (NEFT)

NEFT or National Electronic Fund Transfer is a nationwide electronic fund transfer system that lets you transfer money from one bank account to another. It is a safe and hassle-free process as it is monitored by the RBI. All NEFT settlements are made in a batch-wise format, and funds can be sent through NEFT to accounts of all Indian NEFT-enabled banks. To initiate an NEFT transfer, you would need the account number and name of the receiver, along with the name of the bank branch and its IFSC.